Tax Rates Import

Import Tax Rates to Zoey

Zoey allows you to import Tax Rates with a "CSV" file.

Importing Tax Rates can be fast and easy, but if your Tax Rate information does not match the Zoey format, you will need to re-format it.

Create Your Import CSV File

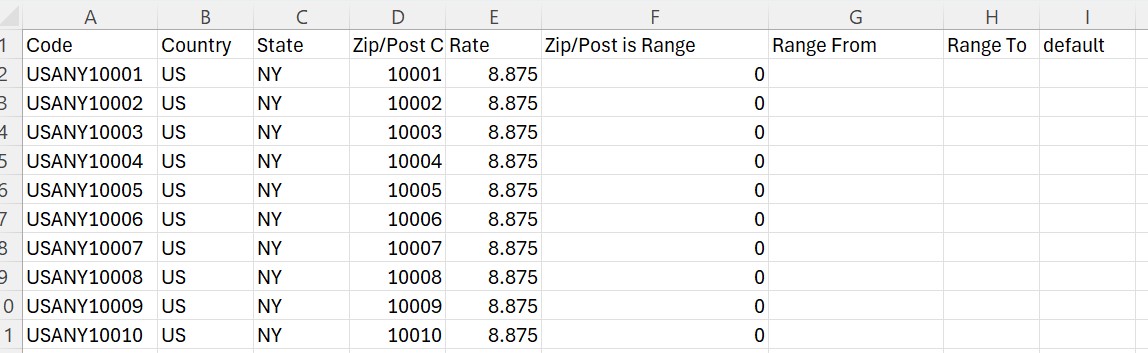

Copy the column headers below or export your existing rates. Code, Country, State, Rate, Zip/Post is Range are required for every rate.

Either Zip/Post Code or Range From & Range To must be included depending on how you are assigning the rate.

| Code | Country | State | Zip/Post Code | Rate | Zip/Post is Range | Range From | Range To |

|---|

Column Header | Description |

|---|---|

Code | A UNIQUE ID for the tax rate. The Code will be shown to the user when checking out if you have the Tax>Settings specified to display full tax summary. Example: NY-US-10000 |

Country | 2-Character Country Code (US, UK) If you want to use a flat rate for any location worldwide, you need to set Tax Calculation Based On to Shipping Origin under Setup > > Tax > Tax Settings and use a wildcard rate for your origin country. You'll always calculate tax from your shipping origin this way. |

State | 2-Character State/Provence Code (NY, NJ)

|

Zip/Post Code | 4/5-Character Zip/Post Codes

|

Rate | Rate is an expressed percentage. Include ONLY numbers and decimal. Example: 8.75 (this will equal 8.75%) |

Zip/Post is Range | Yes = 1 or No = 0 *required field for import |

Range From | 4/5-Character Zip/Post Code starting from and including. |

Range To | 4/5-Character Zip/Post Code up to and including. |

Import CSV

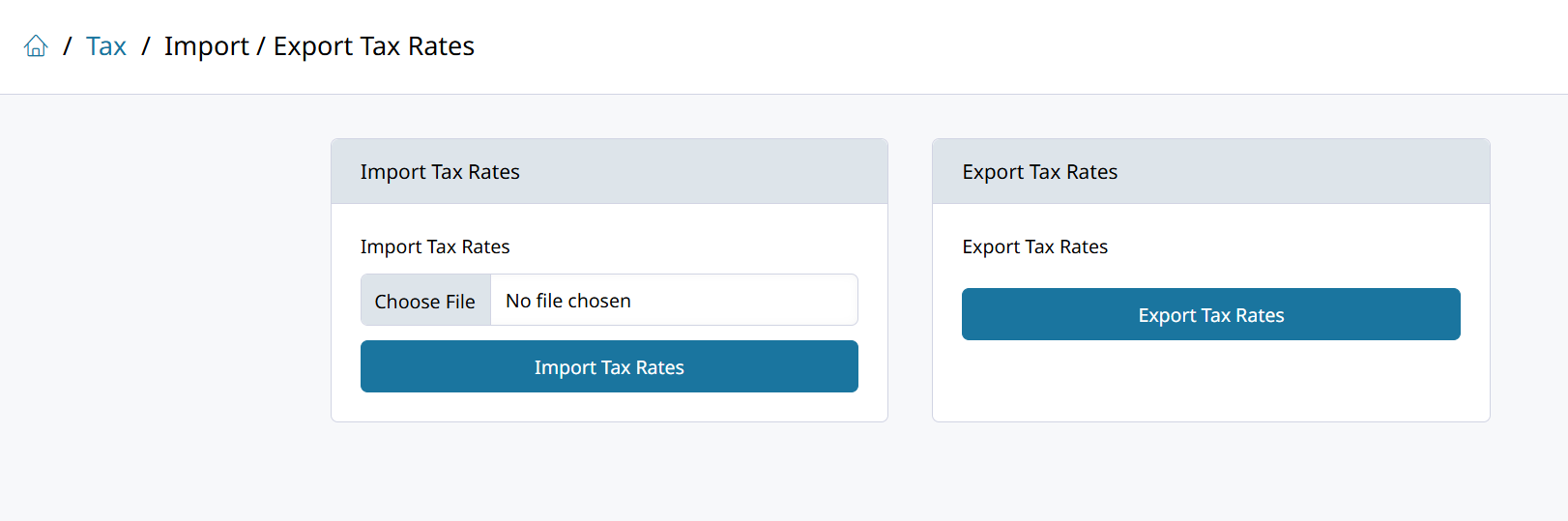

"Invalid File Upload Error"If you are getting an invalid file type uploading error please export your current tax rates (button next to import) and use the first line (the headers) as the basis for your template. Depending on your current tax configuration in Zoey, additional headers may be required to successfully import even if no additional data is needed. Exporting the current rates and copy/pasting the first row (headers) into your CSV file should enable you to upload the file successfully.

Format Cells in your CSV so that leading 0s are NOT removed from the Zip Code.Excel will often remove leading 0's from numbers in your CSV file. But that will cause the Tax Rate's Zip Code to not match the Zip Code on your customer's address. Be sure that your Tax Rate Zip Codes will import with all their digits.

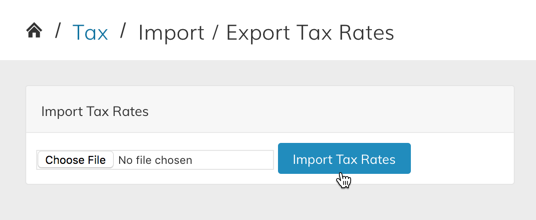

Navigate to Settings > Tax > Import/Export Rates

Choose your file and click Import Tax Rates

Updating Tax Rates

To update your tax rates, export your file from this Import/ Export screen, update your rates for existing zip codes, and then re-import the updated file here.

It is best practice to delete any rows off the file that you do not need to change, and only keep the rows you want to update.

Updated 6 months ago