Setting up VAT

Some countries charge a value added tax, or VAT, on goods and services. (In some countries this is referred to as a goods and services tax, or GST.)

There can be different VAT rates depending on which stage you as a merchant are at in the manufacture or distribution of products, materials, or services that you sell to your customers. In this case, you may need to use more than one VAT rate in your store for tax calculation purposes.

Applying VAT requires familiarity with tax rule creation. We illustrate how to create tax rules in detail here.

Set Up Customer VAT Class

From Settings > VAT > Customer VAT Classes, select or create a customer tax class to use for your VAT rate. We recommend adding a class titled "UK Non-Exempt".

Set up Product VAT Class

From Settings > VAT > Product VAT Classes.

Add or configure existing product VAT classes as needed:

Such as:

- VAT Standard

- VAT Reduced

- VAT Zero (or non-taxable)

When you finish, click Save.

Set Up Tax Zones and Rates

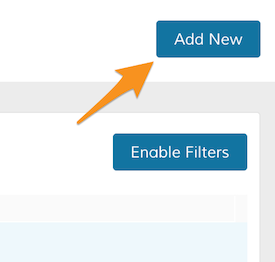

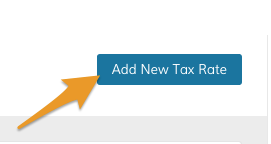

From Settings > VAT > Zones & Rates, click on Add New VAT Rate.

More Tax Rate setup details here.

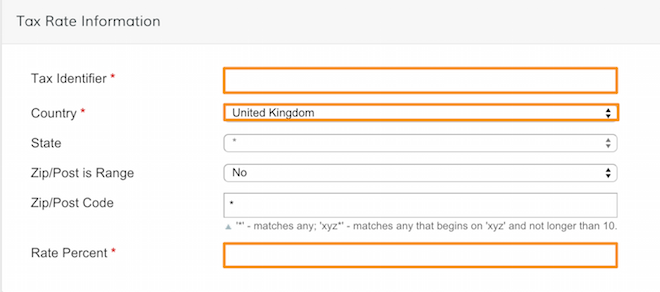

From Tax Rate Information, add new rates, paying special attention to the following fields:

| Tax Identifier | Name of the tax rate. |

| Country | Name of the country represented by the VAT rate. |

| Rate Percent | Current VAT Rate. |

When you finish, click Save.

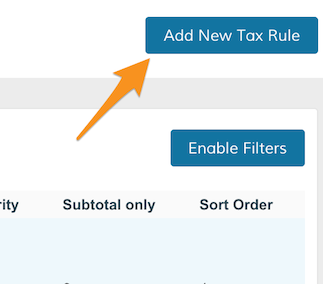

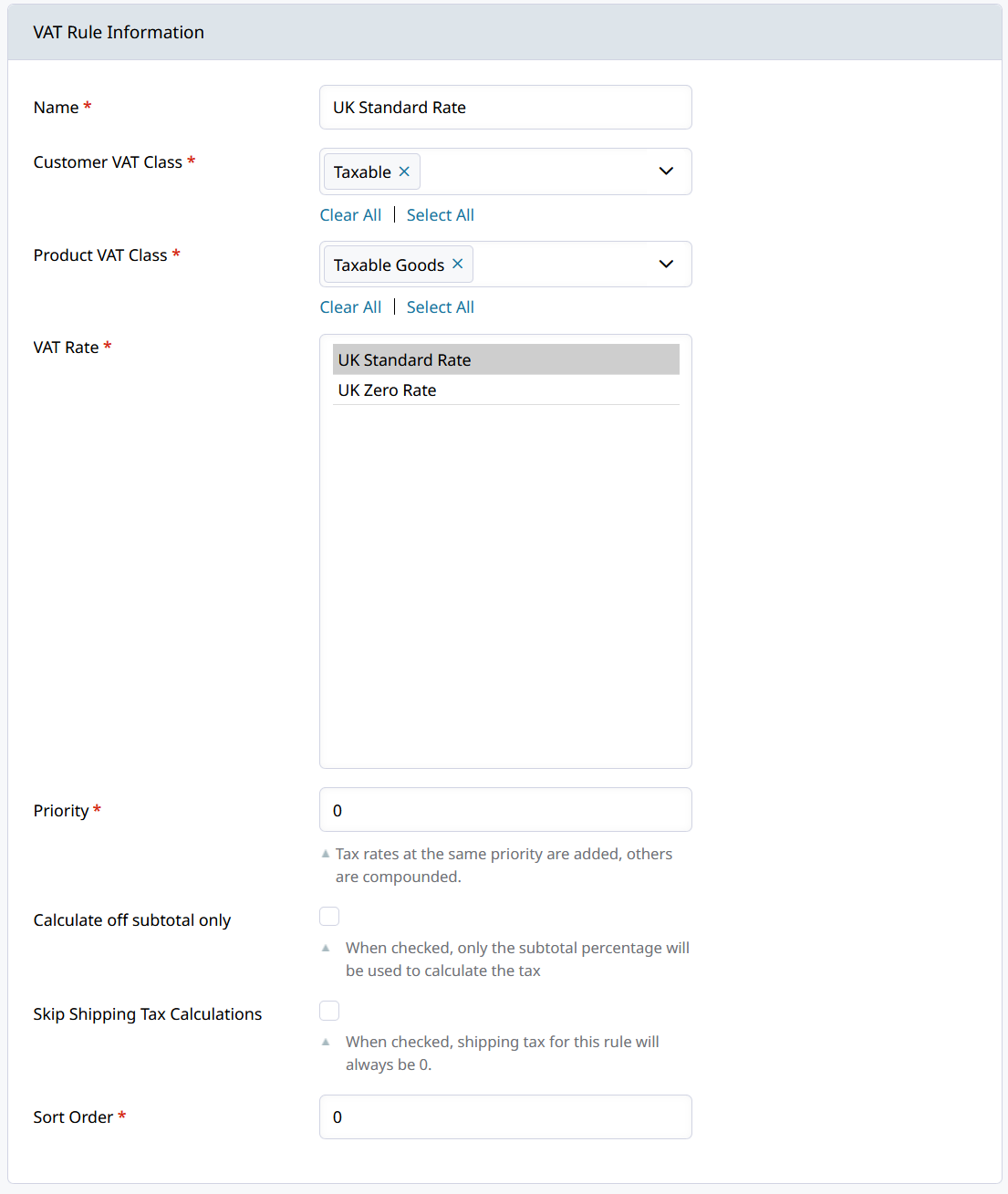

Create a VAT Tax Rule

A tax rule is a combination of a customer tax class, product tax class, and tax rate. From Set-up > Tax > Tax Rules, click Add Tax Rule.

Select the "Customer VAT Class" and the "Product VAT Class". Then select the "VAT Rate" which will be applied to that product and customer class combination.

For example:

VAT Standard

| Name | VAT Standard |

| Customer Tax Class | Retail Customer |

| Product Tax Class | VAT Standard |

| Tax Rate | VAT Standard Rate |

VAT Reduced

| Name | VAT Reduced |

| Customer Tax Class | Retail Class |

| Product Tax Class | VAT Reduced |

| Tax Rate | VAT Reduced Rate |

VAT Zero

| Name | VAT Zero |

| Customer Tax Class | (ALL CLASSES) |

| Product Tax Class | Non-taxable |

| Tax Rate | VAT Zero Rate |

Using a 0% tax rate is needed for QuickBooks integration.

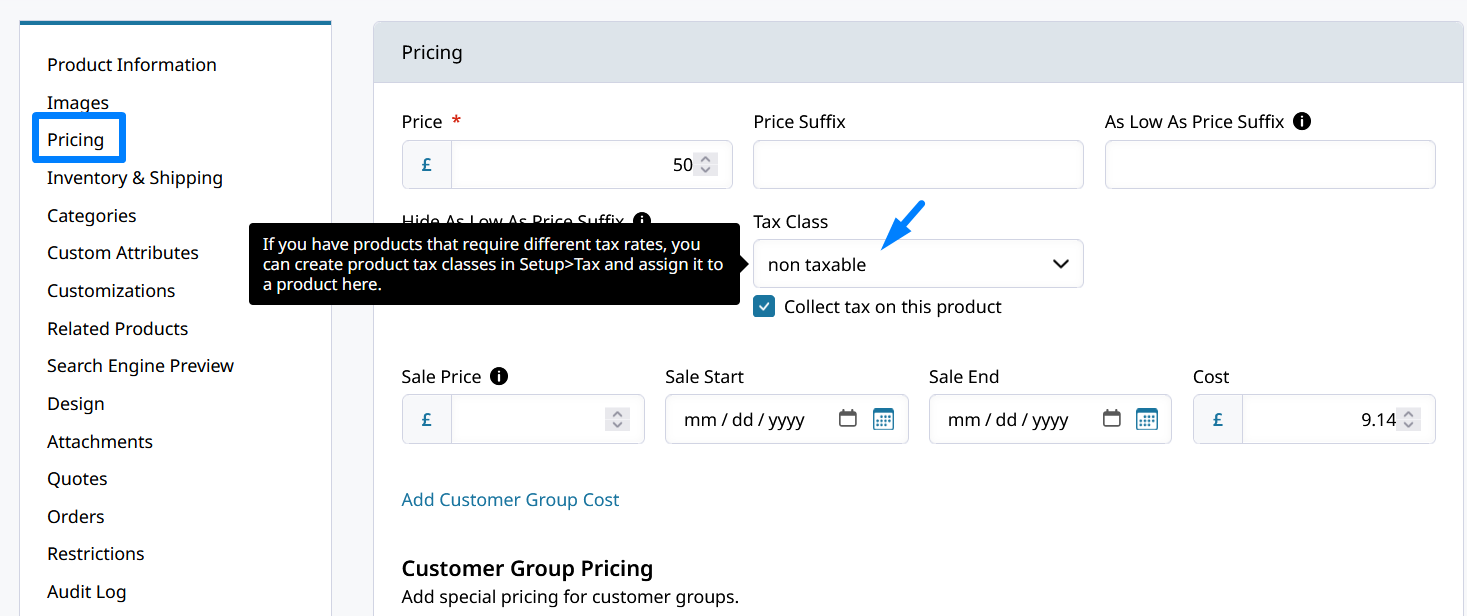

Apply VAT Tax Classes To Products

Go to your Products list and open a product.

Go to the Pricing section and click Specify a tax class to open the product tax class drop-down.

You must check off "Collect Tax on this product" to select the zero tax / non-taxable VAT class. This way QuickBooks and other integrations can be told that the product is not taxable through its class.

Product tax classes can also be set through CSV Import.

Updated 9 months ago