VAT Verification

Value Added Tax Identification (VAT ID) validation allows merchants to create multiple default customer groups that are automatically assigned when customers create accounts. For merchants that sell throughout the European Union or domestically, this makes it simple to ensure your customers with valid VAT IDs are exempt from additional taxes.

Before You Begin

Enabling VAT Verification will utilize Zoey's Customer Groups, Tax Classes, Tax Rates and Tax Rules.

Be sure that each European Union member country is selected. You can review this from Set-up > Localization > Localization Settings, within the Countries Options section.

Create VAT Related Customer Group

From Customers > Customer Groups, create a Customer Group to align with customer VAT IDs. You can refer to your new group for future VAT configurations.

Create VAT Related Classes, Rates and Rules

Set the appropriate rules necessary for VAT verification in each customer scenario. Here are tax rules you will need to create:

Tax Rule 1

Customer Tax Class - You will need classes for three types of customers.

- Domestic customers.

- Customers with invalid VAT ID.

- Customers with a failed VAT ID validation.

Product Tax Class - All product types, except bundle and virtual.

Tax Rate - VAT rate of the merchant's country.

Tax Rule 2

- Customer Tax Class - Intra-union customers.

- Product Tax Class - All product types, except bundle and virtual.

- Tax Rate - VAT rates for all EU countries, except your store's country.

The current rate VAT rate for EU countries is 0%.

Tax Rule 3

Customer Tax Class - You will need classes for three types of customers.

- Domestic customers.

- Customers with invalid VAT ID

- Customers with a failed VAT ID validation

Product Tax Class - Downloadable and Virtual products.

Tax Rate - VAT rate of the merchant’s country.

Tax Rule 4

- Customer Tax Class - Intra-union customers.

- Product Tax Class - Downloadable and Virtual products.

- Tax Rate - VAT rates for all EU countries, except your store's country.

Tax Rule 3 and Tax Rule 4 are only required if you have Bundled and Virtual products.

Enable and Update VAT ID Configuration

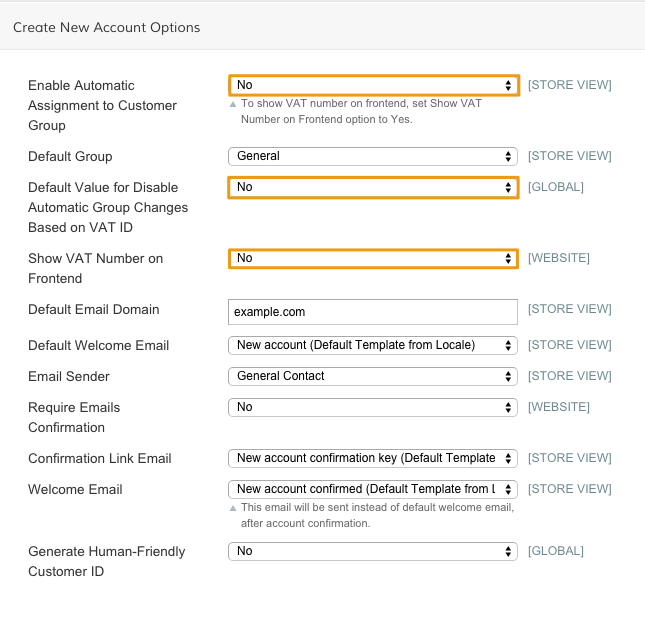

From Control Panel > Customers > Customer Settings, open your Create New Account Options area.

Here are the fields you will configure:

Enable Automatic Assignment to Customer Group - Determines if customers are automatically set to default customer group.

You must set this to Yesto correctly enable VAT verification.

Default Value for Disable Automatic Group Changes Based on VAT ID - Select Yes to determine an automatic change of customer group based on VAT ID.

Show Vat Number on Front end - Select Yes to display VAT number to customers in the store.

After finishing your updates, click Save Config.

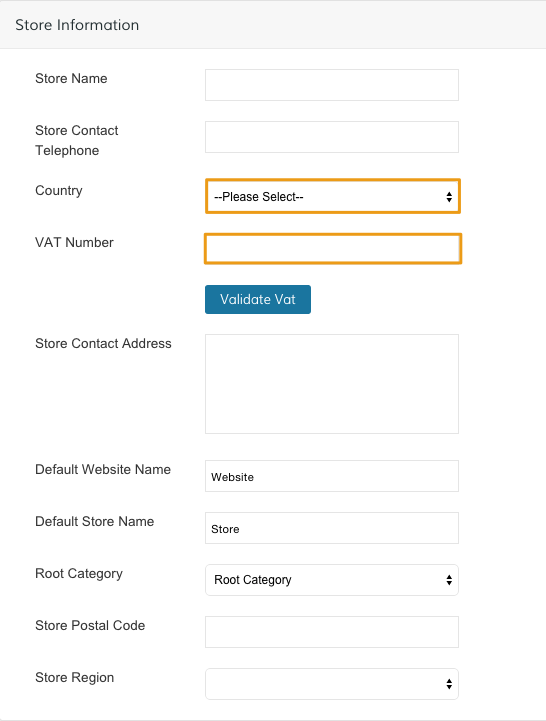

Set VAT ID and Location Country

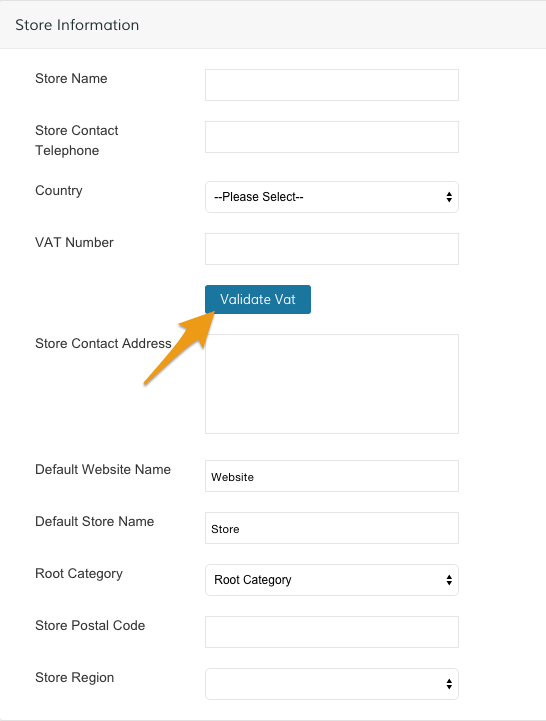

From Control Panel > Set-up > Site Configurations, visit your Store Information section and update the following fields:

- Country - Select your company's native country.

- VAT Number - Enter your VAT Number.

Click Validate Vat to check your VAT value.

If a customer’s VAT validation is performed during checkout, the VAT request identifier and VAT request date are saved in the Comments History section of the Order.

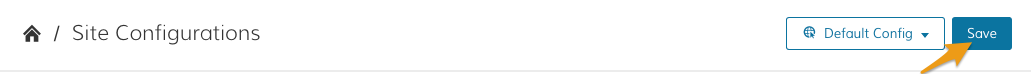

When you finish your updates, click Save.

Updated 9 months ago