Troubleshooting Taxes

Taxes are not being charged

If upon checkout no taxes are being applied you can go through this checklist:

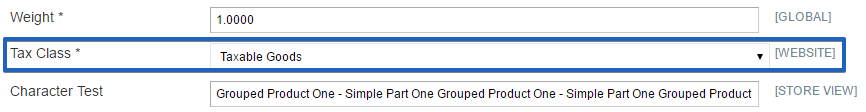

Tax Class

Go to your Product List, open a product and verify that under General Information > Tax Class * it's set to Taxable Goods.

Tax Rates

Make sure you have the correct tax rates set up. Go to Set-up > Tax > Tax Rates (Manage) and add or edit your tax rates with the correct percentage. Take a look at our Tax Rates article for detailed instructions.

Tax Rules

If you have set up your tax rates you need to create tax rules so that the customers are being charged the correct tax rate.

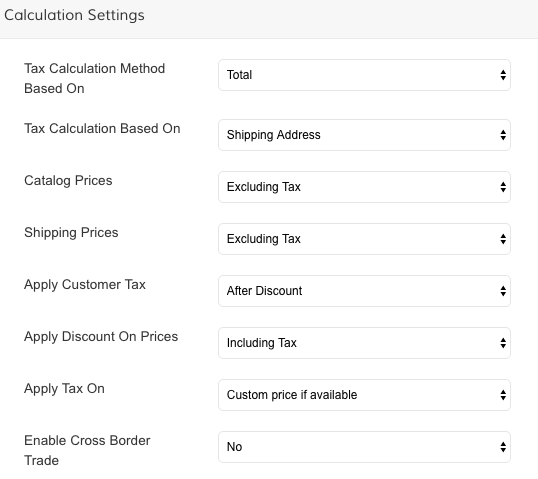

Calculation Settings

Tax not being calculated on custom prices or for items which are originally $0.00.

- Apply Tax On - must be set to "Custom price if available" for tax to be calculated using a custom set price on the order. When set to "Original price only", the original price would only be considered for the tax.

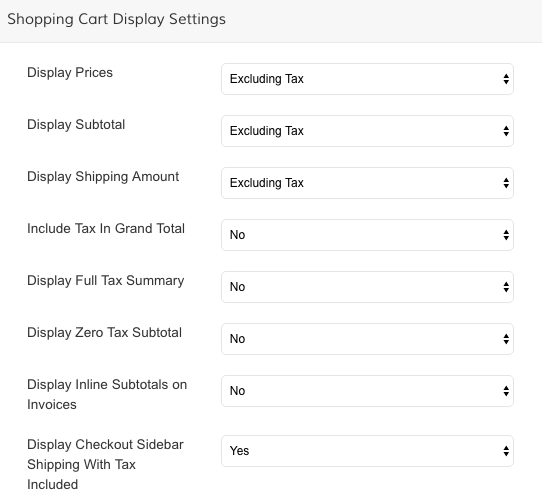

Taxes won't display in checkout

In Set-up > Tax > Tax Settings under Shopping Cart Display Settings you can control how you want your taxes to be displayed during checkout on the storefront.

If you want to display the Grand Total including the tax fee, you need to set Include Tax in Grand Total > Yes.

Additionally you can set to Display a Full Tax Summary.

Display Tax in Product Prices

In Set-up > Tax > Tax Settingsunder Calculation Settings you can determine if your products should display the price including or excluding the tax fee.

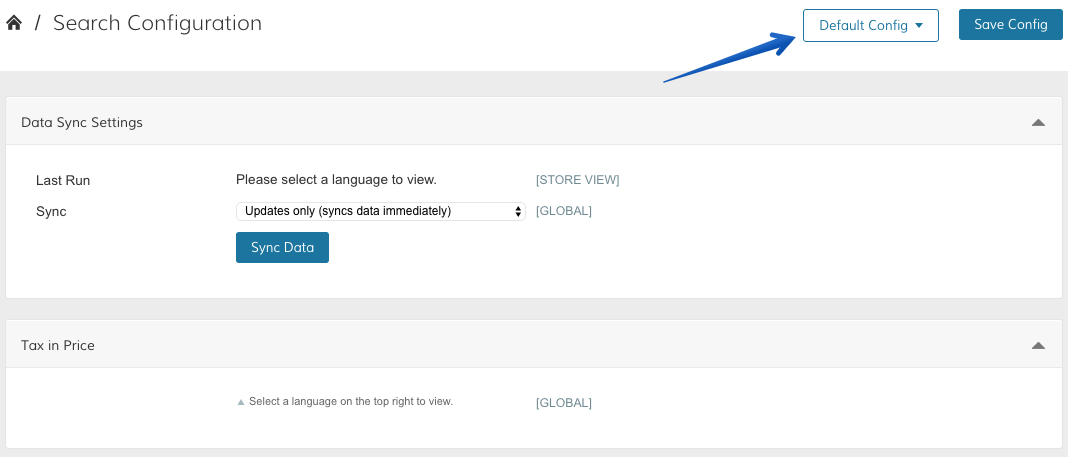

Taxes in Search Results

You can control how to display prices for items in search results. Go to Products > Settings > Catalog Search Settings.

To access the settings you will need to change the store view to your Default Language.

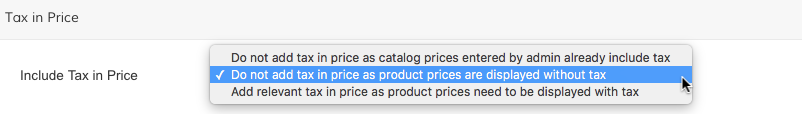

For Tax in Price you can select to

- not add taxes, for the prices in catalog already include taxes

- not add taxes, for product prices are displayed without tax, or

- add relevant taxes to prices.

In the top right click on Save Config and make sure to sync your data.

Changes to Search SettingsAfter making any changes to Search Settings it can take up to an hour until the search module indexes the new data.

Hidden Tax

Do your refund amounts look incorrect? It could be because of Hidden Tax. Check your tax settings

- What is hidden tax?

When a customer pays tax on a discounted product, they are paying tax on the full price of the item. The amount of tax that is collected for the discount is what we call Hidden Tax.

Hidden Tax only comes into play when; Catalog prices include tax, VAT rate is not 0, and a discount is present.

When a refund is issued for that product, the full tax amount will be returned including Hidden Tax.

Incorrect Taxes Amount - AvaTax

If your Zoey store is integrated with our Avalara AvaTax app and the tax amount applied to an order is not correct, you must review your Tax Code configuration within AvaTax.

AvaTax sets the tax amount on your Zoey Orders based on the customer's address. Since that app is in complete control of your Tax Rates, you must rectify the issue in AvaTax.

Click here to find the AvaTax logs.You'll want to provide the logs if reaching out to AvaTax Support.

Updated 9 months ago